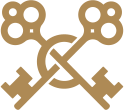

28 Feb Making the Most of Your Extra Cash: Home Renovation, TFSA, or RRSP?

“I have $50,000 extra. What is best for me to do? Should I put it into my home, a TFSA, or RSP?”

Deciding where to allocate your extra cash can be a significant financial decision, with several options available, including home renovation, contributing to a Tax-Free Savings Account (TFSA), or investing in a Registered Retirement Savings Plan (RRSP). Each choice offers distinct advantages and considerations, depending on your financial goals and priorities.

“If you damage the sheathing underneath a badly curved roof, the cost to repair the roof could double.” Your kitchen appears good, for instance, if your roof has been completed. You could fit it into that, for example, if your bathroom and kitchen are from 1950 and 1960, respectively. All I can tell is that, in terms of your home, it’s possible that you have a foundation leak, that you wish to install quartz countertops, replace your doors, hardware, and counter.”

1. Home Renovation:

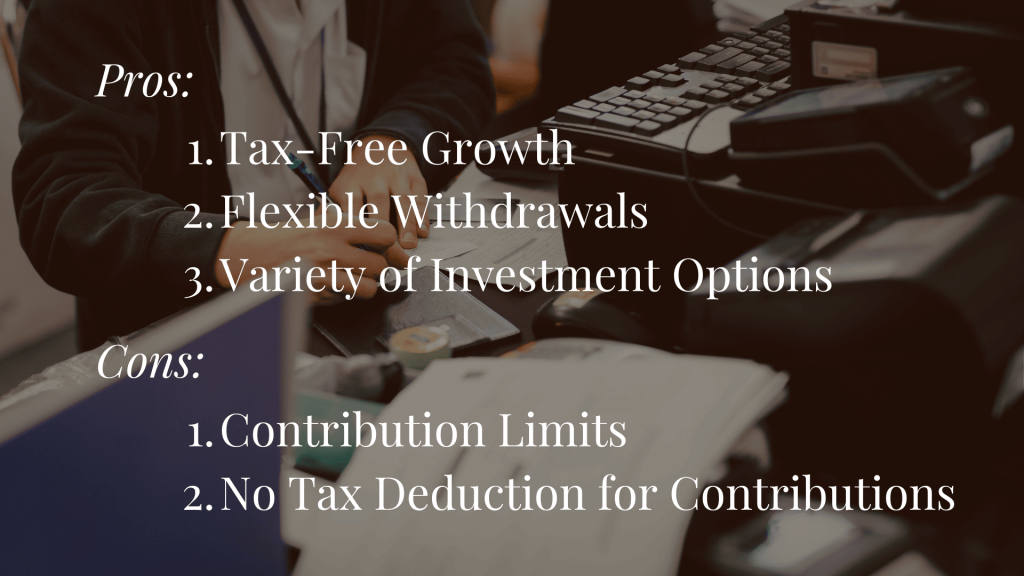

2. Tax-Free Savings Account (TFSA):

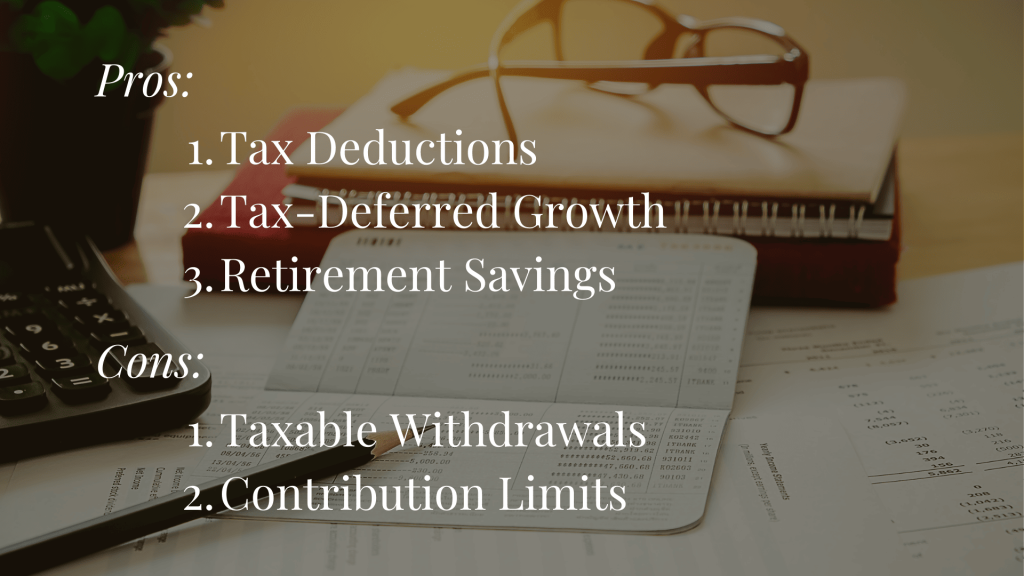

3. Registered Retirement Savings Plan (RRSP):